📢 We're Hiring! 📢

Looking for a rewarding job where you can make a difference in the lives of students? Join the Twin Falls School District! We're hiring paraeducators, computer aides, crossing guards, playground aides, cooks, and more.

Every role in our schools helps support student learning and success. 💡📚✨

💰 Starting pay: $15/hour

📲 Scan the QR code or visit our website to apply today! https://www.applitrack.com/twinfalls/onlineapp/default.aspx?all=1

#TFSDJobs #NowHiring #SupportEducation #MakeADifference

Check out our newsletter!

Read the most recent edition of the TFSD newsletter, The District Focus, here: https://tfsd.edurooms.com/engage/twin-falls-school-district/newsletters/district-focus-winter-24-25

📢 We're Hiring! 📢

Looking for a rewarding job where you can make a difference in the lives of students? Join the Twin Falls School District! We're hiring paraeducators, computer aides, crossing guards, playground aides, cooks, and more.

Every role in our schools helps support student learning and success. 💡📚✨

💰 Starting pay: $15/hour

📲 Scan the QR code or visit our website to apply today! https://www.applitrack.com/twinfalls/onlineapp/default.aspx?all=1

#TFSDJobs #NowHiring #SupportEducation #MakeADifference

No School!

Happy Presidents' Day! No School.

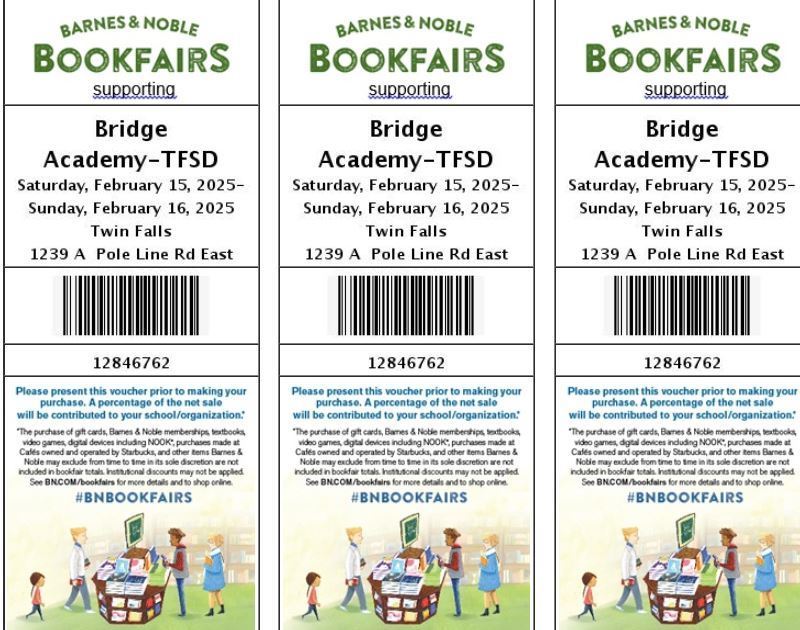

📚✨ Last Day to Support Bridge Academy at Barnes & Noble! ✨📚

A portion of all sales made using our Bookfair ID: 12846762 will support our school! Shop online at https://www.barnesandnoble.com/ from February 12 – 16 and enter Bookfair ID: 12846762 at checkout.

Every book you buy helps our students! 📖❤️ Thank you for your support! #BridgeAcademy #SupportOurSchool #BarnesAndNobleBookFair

Special Education Preschool is provided for children between the ages of 3 years to 5 years old who are eligible for special education and related services. If you have concerns about your child’s development, or if your child has not yet met the above milestones, or if they are currently receiving private speech/language therapy, they may be eligible for the developmental preschool program. Screenings are held monthly (August – April) at Harrison and Pillar Falls Elementary. Call for an appointment:

Harrison (families living west of Blue Lakes Blvd.) 208-733-4229

Pillar Falls (families living east of Blue Lakes Blvd.) 208-732-7570)

📚✨ Support Bridge Academy Tomorrow at Barnes & Noble! ✨📚

Join us on February 15, 2025, from 10 AM – 9 PM at Barnes & Noble (1239 Pole Line Rd E Suite 314C, Twin Falls, ID) for a special Book Fair benefiting Bridge Academy! A portion of all sales made using our Bookfair ID: 12846762 will support our school.

💻 Can't make it in person? No problem! Shop online at BN.COM/bookfairs from February 12 – 16 and enter Bookfair ID: 12846762 at checkout.

Every book you buy helps our students! 📖❤️ Thank you for your support! #BridgeAcademy #SupportOurSchool #BarnesAndNobleBookFair

Reminder! In observance of President's Day, there will be no school February 17th-18th. School will resume Wednesday, February 19th. Enjoy the long weekend!

Join us for a fun-filled family event at Bridge Academy! Come play BINGO and win new books to take home. Enjoy a night of games, laughter, and literacy with your student! Food will be available for purchase from a local taco truck during our event! Every student will go home with a new book. We can wait to see you!

📚✨ Support Bridge Academy at Barnes & Noble! ✨📚

Join us on February 15, 2025, from 10 AM – 9 PM at Barnes & Noble (1239 Pole Line Rd E Suite 314C, Twin Falls, ID) for a special Book Fair benefiting Bridge Academy! A portion of all sales made using our Bookfair ID: 12846762 will support our school.

💻 Can't make it in person? No problem! Shop online at BN.COM/bookfairs from February 12 – 16 and enter Bookfair ID: 12846762 at checkout.

Every book you buy helps our students! 📖❤️ Thank you for your support! #BridgeAcademy #SupportOurSchool #BarnesAndNobleBookFair

We are thrilled to announce the opening of Hello Dolly on Valentine’s Day (Feb 14th)! 🎉 Thanks to an amazing collaboration between TFHS students and staff, this production is sure to be a night to remember. 💫

Special shout-out to:

Cameron Hoge & Roger Miskin in the Construction CTE program, for building the stunning set! 🔨🏗️

Mr. Child, our talented choir director, who is also serving as the music director for this amazing show! 🎶

Haven Elison, our gifted student choreographer, who choreographed almost the entire show—this senior deserves a lot recognition! 🌟

Show Details:

Dates: Feb 14, 15, 21, 22

Time: Doors open at 6:30 PM, Show starts at 7:00 PM

Ticket Prices:

$10 for adults

$5 for K-12 students

$35 for a family of 6

Come support the TFHS community and enjoy an unforgettable night of talent, teamwork, and creativity! 💃🎭🎶

#TFHS #CommunityCollaboration #SupportTheArts #StudentChoreography #Showtime #ValentinesDay #Theater #HighSchoolArts

📚✨ Support Bridge Academy at Barnes & Noble! ✨📚

Join us on February 15, 2025, from 10 AM – 9 PM at Barnes & Noble (1239 Pole Line Rd E Suite 314C, Twin Falls, ID) for a special Book Fair benefiting Bridge Academy! A portion of all sales made using our Bookfair ID: 12846762 will support our school.

💻 Can't make it in person? No problem! Shop online at BN.COM/bookfairs from February 12 – 16 and enter Bookfair ID: 12846762 at checkout.

Every book you buy helps our students! 📖❤️ Thank you for your support! #BridgeAcademy #SupportOurSchool #BarnesAndNobleBookFair

It's National School Counseling Week and this years focus is THRIVING! Every student needs a school counselor who.. "listens and celebrates who they are, no matter what!" -Eden #NSCW25

It's National School Counseling Week and this years focus is THRIVING! I'm a School Counselor Because... "I strive to be the supportive and trustworthy adult I once needed as a teenager!" -Ms. Jessica #NSCW25

It's National School Counseling Week and this years focus is THRIVING! I thrive as a school counselor when... "I am taking care of myself so that I can give 100% to my students. Also, when my students demonstrate personal growth!" -Ms. Jessica #NSCW25

It's National School Counseling Week and this years focus is THRIVING! I know students are thriving when... "they feel safe, accepted, and supported to be their true selves!" -Josselyn #NSCW25

It's National School Counseling Week and this years focus is THRIVING! School counselors help students thrive by...

"Offering them a safe place to talk about hard things, cope with stress, and advocate for them!" -Ms. Jessica

#NSCW25

Check out the most recent newsletter from the School Well-Being Program (free counseling and mental health navigation services) and BPA Health. We are proud to be able to offer these resources to our students and their families! https://conta.cc/49FOL8x